|

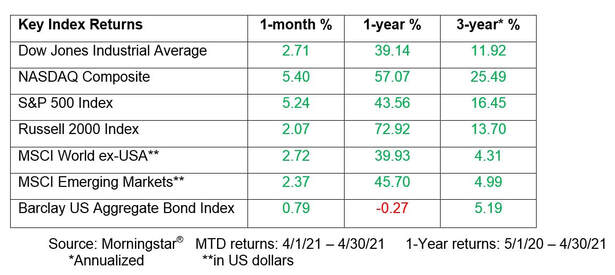

Dear Friends, Is there anything better than feeling good? What does that mean? Certainly, everyone wants to have good health. Illness and physical maladies, while a fact of life, are no fun. My mother is fond of reminding me that, “Old age ain’t for sissies”. And, as always, she is right. So, please stay healthy, my friends. The other thing about “feeling good” is emotional and/or mental. When we are in a “happy place” and nothing bothers us, is there anything better than that? Attitude plays so much a part of this. I hope all your glasses are more than half full. Why do I bring up this touchy/feely stuff? When you received your first vaccine, how did you FEEL? Happy? Thankful? Grateful? Relieved? Free? Euphoric? If so, please share that feeling with your friends whom, for whatever reason, have chosen to wait or not be vaccinated. Let them know you did it for them (even if many of us may be self-motivated) and want them to have the same joyous feeling. As the famous philosopher and songwriter, James Taylor, wrote, “The Secret of Life is Enjoying the Passage of Time” (from his 1977 album titled JT). Better to feel good and enjoy than not! ZOOM Webinars for Clients Last month’s presentation on “Education Planning and Funding Strategies” is available for replay. The broadcast can be found in the Media & Posts tab on our website www.realityfinancialplanning.com. Also posted on the site is “The SECURE Act and How Tax Changes Impact Retirement” webinar we presented in March. This is a very important topic that we will likely revisit in the coming months. There are several topics that we plan to cover via Zoom soon. One important item will be a summary of all the potential tax changes that the Biden administration is proposing and how they may impact you. We are also considering doing a presentation on senior caregiving and legacy planning. Many families avoid discussing these matters, but it is imperative to begin making plans for the inevitable. Of course, if there are any other topics for which a Zoom presentation would be relevant to you, please let us know. Stay tuned. Growth Here, Not There You are unlikely to find a bigger contrast in economic fortunes than the one between the U.S. and Europe as we finally come out of the pandemic crisis. In the U.S., the real gross domestic product—the sum of all goods and services produced in America—grew by an annualized rate of 6.4% in the first quarter of the year—and that’s on top of a 4.3% growth rate in the fourth quarter of 2020. The first quarter statistic represents the second-fastest pace of growth since the second quarter of 2003. The U.S. government’s Bureau of Economic Analysis noted that personal consumption expenditures, business investment and federal, state, and local government spending were all contributors to the growth. The most eye-popping number: disposable personal income increased 67% in the first quarter, compared with a decrease of 6.9% in the fourth quarter of last year. The stimulus checks apparently had their intended effect. Meanwhile, the euro zone economy saw its gross domestic product decline by 0.6% in the first quarter, and in sharp contrast to the U.S., this was the second consecutive quarter of contractions. Germany’s economy fell by 1.7% in the first three months of the year, Italy showed a contraction of 0.4%, Spain and Portugal saw their economic activity shrink by 0.5% and 3.3%, respectively. Needless to say, the U.S. has not totally returned to pre-COVID levels yet. The Federal Reserve estimates that some 8.4 million Americans hold fewer jobs now than prior to the pandemic; the unemployment rate stands currently at 6.0, above the 3.5% low in February of 2020. While finger-pointing has become a national pastime, the case for United States growth and recovery is important. However, Interestingly, if the reports are to be believed, China has fully recovered and posted a whopping 18.3% GDP growth rate. That is their strongest quarterly growth rate since 1992. Total recovery is possible. Market Review The rebound continues. For sure the economic stimulus payments and increased vaccine rollout have spurred the economy and, ergo, the market has chugged higher.

Last week, Federal Reserve chairman Jerome Powell essentially indicated that the Fed would remain accommodative into the next several months. Yay! In a recent podcast, Vanguard’s Global Chief Economist Joe Davis commented that “its likely that in the next 12 months we will see the highest growth rates in the United States that we’ve seen since the early 1980s. We will see China-like growth for a time in the United States.” Now that is positivity! The only potential negative that may appear (and this is such a non-event) is the potential for core inflation to rise. The Fed mandate of 2% inflation may come to fruition in the second quarter as economic activity normalizes further. What this means is that we may see some higher gas prices as people travel more. Grocery prices should moderate since (hopefully) people will be eating out more and not hoarding toilet paper. So, we are in a Goldilocks environment. And that is a good thing. Conclusion Hopefully the rejuvenation after the COVID-induced malaise has you making plans to enjoy your freedom this summer. If you are traveling, be safe. Please stay healthy (physically and emotionally) and don’t forget the sunscreen. As always, thank you for the trust and confidence you place in us. It is something we never take for granted and sincerely appreciate. Please do not hesitate to reach out whenever you have questions, concerns or whenever we may be of service to you. Sincerely, Joe Downs, CFP® & John Cunningham, CFP Comments are closed.

|

Company |

Copyright © 2021, Reality Financial Planning Services, LLC. All rights reserved.

All rights herein are copyright protected and may not be reproduced without the express written permission of the copyright owner.

All rights herein are copyright protected and may not be reproduced without the express written permission of the copyright owner.