|

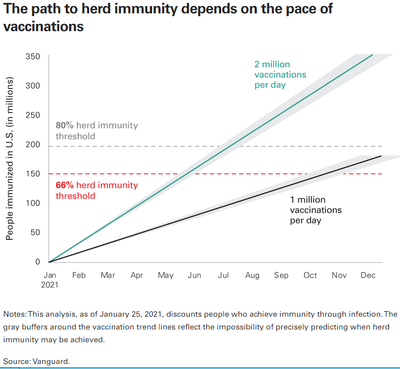

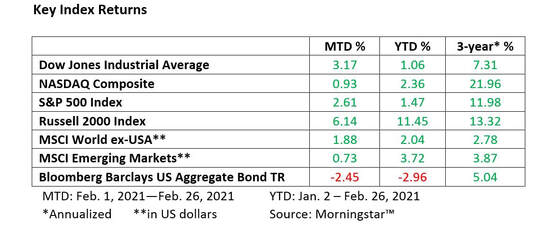

Dear Friends, It is sort of strange, but not unexpected, that one of the main subjects we hear about in conversations with friend and clients starts with a question that has become a common refrain: “Have you gotten your shots?” Hopefully you are getting closer to your magic vaccination number, unless you are one of the fortunate few that have received your shot(s). A year ago, the only herds anyone talked about was on a cattle farm – immunity from a virus was certainly not top of mind. At this point, the path to herd immunity is predicated on how quickly the vaccine can be fully rolled out and we get “needles in arms”. One could also easily make the case that economic recovery is also predicated on the pace of vaccine rollout. According to research done by the Vanguard Group, they estimate U.S. GDP growth will be above 5% for 2021 – and that does not include any additional governmental fiscal support. Their estimate rises to 6.5% if further fiscal support comes to fruition, including direct aid to families, and to state and local governments with additional health-related efforts. SECURE Act and Tax Update ZOOM Webinar for Clients The biggest story of the past year has been, obviously, COVID and the pandemic. In early January last year, though, the SECURE Act was passed and may have fallen off many folks’ radar screens. However, to overlook the ramifications of the legislation for anyone with IRAs, their beneficiaries, and their retirement success would be a big mistake. So, the topic of our next Zoom webinar will be a refresher of the important aspects of the SECURE Act, how they impact all of us, and an update on several other tax legislation topics. We will also refocus on the ever looming IRMAA – the years-old legislation that can cause hurricane-like impact on your financials (pun intended, but not funny). IRMAA is the Income Related Medicare Adjustment Amount. We will have “room” space for 100 attendees. If you are interested in attending, the webinar will be Wednesday, March 24, at 5:00 and presented via ZOOM. To register, please email us at [email protected] and we will send you the log-in details. Market Update Technically, the economy is still in a recession. The National Bureau of Economic Research (NBER), the arbiter of recessions and economic recoveries, has yet to declare that the recession is over. When it does, it will likely backdate the end of the recession, as it has done in the past. Key economic reports would suggest the low point for the economy occurred in April 2020. These include employment, consumer spending, and manufacturing production (U.S. BLS, U.S. BEA, and the Federal Reserve, respectively). The top of the cycle occurred in February 2020. Whenever the NBER makes its declaration, this economic recovery has been far from what might be considered a normal recovery. The pandemic that led to the steepest slide in quarterly GDP on record (U.S. BEA, quarterly records began in 1947) has also shaped one of the most lopsided recoveries we’ve ever experienced. Look no further than service-based industries that require the personal interactions to thrive, which is something we took for granted pre-COVID. Social distancing restrictions and fear of contracting the virus have severely impacted airlines, hotels, travel, restaurants, concerts, and movie theaters. These industries and more have struggled to adapt to the new normalcy. But other industries have adapted. For example, housing relies heavily on the personal touch. But record low interest rates have spurred strong demand for housing. Essential retailers, home improvement, auto sales, and grocery stores have experienced robust numbers. Consequently, manufacturers were caught off guard by the resurgence in sales. A February 22 story in the Wall Street Journal sums it up well: Consumer Demand Snaps Back, Factories Can’t Keep Up. Snarled supply chains, labor shortage thwart full reopening; “Everyone was caught flat-footed.” Reopening various sectors of the economy has helped, and generous jobless benefits and two rounds of stimulus checks have left many with ample cash to spend. While the final touches aren’t yet on the latest relief package, more cash is likely on the way. The extra government support that has helped fuel growth has been funneled into some industries or into savings. I recognize these measures are needed, but, as artificial barriers, has severely hampered others. The newly proposed relief package that is currently pegged at around $1.9 trillion seems likely to pass soon. Expect the new cash to support the economy and to continue to support various sectors that have benefitted at the expense of other sectors. What might help the beleaguered industries that have suffered under today’s restrictions? For starters, a sustained, successful rollout of the vaccines that greatly reduces the odds one can contract COVID. But I also want to be careful not to sound too gloomy. It’s been a difficult year and there’s plenty of uncertainty, but prospects this year look bright. One closely followed GDP-tracking model from the Atlanta Federal Reserve Bank places Q1 growth at 10%. A survey of economists by suggests GDP growth this year could top 6%. That is in line with the Vanguard Group analysis we touched on earlier in this note. Economic forecasting, which is never easy, is even more difficult in today’s environment. Still, forecasters are sounding an optimistic tone. We believe you can too. So, What Now?

With vaccines comes hope of getting back to normalcy. When the pandemic abates, the markets should find stable footing again. Bottom Line If you have not received your vaccine yet, hopefully it will be soon, so please hang in there. In the meantime, take care of yourself, stay safe, enjoy your life. As always, if you have questions, concerns or would like to chat about anything, please let me know. Thank you for the opportunity to be of service. Sincerely, Joe Downs, CFP® and John Cunningham, CFP® Comments are closed.

|

Company |

Copyright © 2021, Reality Financial Planning Services, LLC. All rights reserved.

All rights herein are copyright protected and may not be reproduced without the express written permission of the copyright owner.

All rights herein are copyright protected and may not be reproduced without the express written permission of the copyright owner.