|

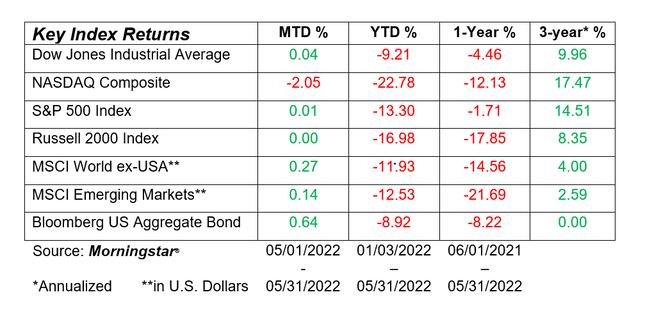

Dear Friends, Happy June, everybody. Hopefully this note finds you happy, healthy, and looking forward to some fun this summer. Please stay safe, enjoy yourselves, keep the news media exposure to a minimum, and don’t forget the sunscreen. If you are traveling or settling in by the pool, enjoy the following insights. Despite all the pessimism that is so pervasive, we will do our best to be your source for a little positivity. Recession or Blip You have likely read about an “impending recession,” which sounds kind of scary, especially for those of us who remember the Great Recession of 2008-9. The question right now is: are we already in a recession, or just experiencing another bump in the roller coaster? A recession is defined as a two-consecutive-quarter decline in total economic activity—the Gross Domestic Product, or GDP—that leads to at least 1.5% overall decline, and at the same time, unemployment reaches 6%. This has happened 33 times since our government began keeping score in 1854, so it’s not particularly unusual. (Source: TradingEconomics.com). Recently, we met one of the inputs in the definition. According to the U.S. Bureau of Economic Analysis, the U.S. economy recorded a rather significant 1.5% decline in overall growth in the first three months of 2022, led by decreases in motor vehicle sales and utility activity. But we are very far from the unemployment rate ‘target’—unemployment today is running at about 3.6%. And, of course, there are those other quarters of decline that would need to happen. The U.S. is hardly alone in its first quarter malaise; overall, the GDP of the world’s developed economies rose by just 0.1% over the first three months of the year, with Italy, Japan and France all experiencing moderate declines. The persistence of the Omicron Covid variant, continuing supply chain snafus and, of course, the war in Ukraine all seem to be temporary factors—although it must be admitted that many economists thought of them as temporary months or even years ago. The good news, though, is that consumers and business in the U.S. are still spending and investing, and that is a good thing. Market Update – Flat is the New “Up” We were treated to one of the greatest bull markets in modern history during the last decade. It’s not that we didn’t experience selloffs. We did. The start of the year has been “challenging”. From its closing peak of 4,796.56 on January 3, the S&P 500’s most recent closing bottom of 3,900.79 on May 19 translates into a peak-to-trough loss of 18.68% (MarketWatch). As we moved into the final days of May, a sharp rally helped minimize losses for the month, as illustrated in the below table. This past month had the best performance of the year so far by being flat! What fueled the rise in stocks over the last decade and what has changed today? During the 2010s, interest rates were extremely low; the Fed was buying Treasury bonds during the early part of the decade (popularly called quantitative easing or QE); inflation was low; and the economy was expanding at a modest, if unimpressive, pace. That economic expansion fueled a rise in corporate profits.

When the Fed began to raise rates, the shift in policy was gradual. While stocks never rise in a straight line, the economic fundamentals created a strong tailwind for equities. A brief review of the data from Yahoo Finance shows that on December 31, 2009, the S&P 500 Index closed at 1,115. Ten years later, the S&P 500 had nearly tripled to 3,231. On May 31, it closed at 4,132. What’s going on today Today, the economy is expanding, and corporate profits are rising. But an upbeat Q1 profit season failed to stem the latest slide in stocks. Why? We believe you can point to a shift in the once-favorable fundamentals. First, let’s start with the Federal Reserve. During prior rate-hike cycles, such as the early 2000s and the second half of the 2010s, the Fed took great pains to reassure investors that increases would be “measured” or “gradual.” The investor-friendly language has been jettisoned. In hindsight, the Fed should have started tightening the monetary screws with rate hikes last year. It didn’t. It insisted that last year’s rise in inflation was “transitory.” It wasn’t (another Covid casualty). In response to the sharp rise in inflation, the Fed is being forced to play catch-up. In addition to rate hikes, the Fed will also let some of the maturing bonds it holds run off its balance sheet without replacing them. It’s the opposite of QE, and it’s called QT—quantitative tightening. As with rate hikes, it’s a shift away from the Fed’s easy money policy. While the Fed should take some responsibility for today’s high inflation, we won’t blame it entirely on them. Excessive fiscal stimulus encouraged a consumer-led buying binge (and a fast return to full employment), and supply chain woes that limited the availability of some goods are part of the problem, too. Further, severe labor shortages have lifted wages, and businesses are passing along the higher costs. Market volatility is also being exacerbated by Russia’s invasion of Ukraine, which has pushed up energy prices and appears poised to slow global growth. Recent lockdowns in China have aggravated supply chain issues. Glass Half Full Stocks have a long-term upward bias, but downturns can be swift and uncomfortable. We understand that. But a review of the long-term data is encouraging. The Schwab Center for Financial Research analyzed S&P 500 data going back to 1966. You can read their research at: [[https://www.schwab.com/learn/story/7-investing-strategies-to-prepare-bear-markets]] While we know that past performance doesn’t guarantee future results, Schwab found that the average bear market lasted 446 days (including weekends/holidays). The average bear market decline was 38.4%. Here is the good news. Bull markets averaged 2,069 days and returned an average of 209.2%. “I never have the faintest idea what the stock market is going to do in the next six months, or the next year, or the next two,” legendary investor Warren Buffett once quipped. He’s right. That said, Buffett has a disciplined investment plan. He follows it, and he has an enviable track record. Buffet knows markets don’t rise without corrections. His investment plan and your investment plan account for unexpected detours--you know, when markets take an unscheduled detour lower. Successful investors are disciplined. They avoid letting excess optimism or pessimism guide their decisions. We know times like these can be challenging. If you have questions or would like to talk, we are only an email or phone call away. Final thoughts Have a safe and healthy summer. Stay cool and hydrated. Get your hurricane plans prepared. Take care and enjoy your life. As always, thank you for the trust and confidence you place in us. It is something we never take for granted and sincerely appreciate. Please do not hesitate to reach out whenever you have questions, concerns or whenever we may be of service to you. Sincerely, Joe Downs, CFP® & John Cunningham, CFP® Comments are closed.

|

Company |

Copyright © 2021, Reality Financial Planning Services, LLC. All rights reserved.

All rights herein are copyright protected and may not be reproduced without the express written permission of the copyright owner.

All rights herein are copyright protected and may not be reproduced without the express written permission of the copyright owner.