|

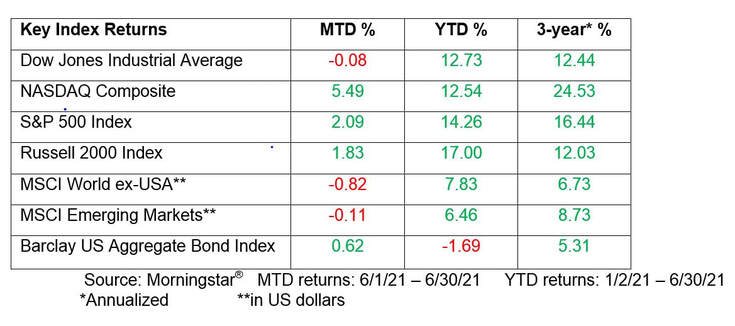

Dear Friends, This weekend we celebrate July 4th – Happy Independence Day to you. Hopefully you have plans to finally gather with friends and family and perhaps travel to somewhere that you have been longing before the craziness of the past year set those plans asunder. The upcoming holiday is impetus to remind ourselves what exactly we are celebrating. We don’t have to revisit the Boston Tea Party and signing of the declaration to recall the lexicon of the time. Words such as freedom and independence can sometimes lose their relevance over time. While we may not be seeking to extricate ourselves from the British, after the pandemic year and disruption to our lives, we are trying to form a “more perfect union” and regain normalcy to our lives and, hopefully, find cohesiveness and commonality as we break away from the ravages of COVID. Following vaccinations, we immediately felt a sense of liberation. We can “free” ourselves from the oppression of masks if we so desire. We can go where we want when we want “independent” of physical distancing mandates if we choose. And while we would love to “dissolve the political bands” that so divide us and cause unnecessary consternation among many, hopefully our fellow Americans will have “respect to the opinions of mankind”. There is no doubt that we can all be amenable to accepting the “unalienable Rights…of Life, Liberty and the Pursuit of Happiness”. In our opinion, that is what we celebrate. Public Service Announcement: If you are so inclined and have some spare time over the summer, there is a huge shortage of badly-needed blood products (whole blood and plasma). Donating blood does not take much time and can literally be a lifesaver. Suncoast Blood Centers (866-972-5663) or One Blood (888-936-6283) would be happy to help you find a convenient time and location. Some gifts are more precious than others. Please enjoy your Holiday and summer in whatever manner you find pleasurable. If you find yourself playing in the great outdoors, don’t forget to hydrate and use sunscreen. Take care, be well. ZOOM Webinars for Clients Last month’s presentation on “The Biden Tax Plan and SECURE Act 2.0” is available for replay. The broadcast can be found in the Media & Posts tab on our website www.realityfinancialplanning.com. We are taking a break from the webinars in July. Stay tuned for announcements about our upcoming webinar schedule. Economic Overview The U.S. economy grew at a solid 6.4% rate in the first three months of the year, setting the stage for what economists believe may be the strongest year for the economy in about seven decades. Growth in the gross domestic product, the country’s total output of goods and services, was unchanged from two previous estimates, the Commerce Department said last week, an acceleration from the 4.3% pace of the fourth quarter. Economists believe that economic growth continued to accelerate this past quarter, which ended June 30, as vaccinations become widespread and Americans eager to get outside are being welcomed by newly reopened businesses. Surging activity from consumers is being fueled in part by nearly $3 trillion in financial support that the government has approved since December. “This summer will be hot for the U.S. economy,” said Lydia Boussour, lead U.S. economist for Oxford Economics. “As the health situation continues to improve, consumers sitting on piles of savings will give into the urge to splurge on services and experiences they felt deprived of during the pandemic.” Boussour forecast that GDP growth in the past April-June quarter surged to an annual rate of 12% and growth for the entire year will come in at 7.5%. That would be the best annual performance since 1951. Even economists whose forecasts for 2021 growth range from 6% to 7% believe growth this year will be the best since a 7.2% gain in 1984, when the U.S. was emerging from an extended and painful recession. Economists believe growth last quarter will be enough to push GDP output above the previous peak reached at the end of 2019 before the pandemic struck and cut off the longest economic expansion in U.S. history. And most importantly, the number of Americans applying for unemployment benefits continues to drop as the job market continues to heal, albeit more slowly than many economists expected at this point in the recovery. Market Perspectives Expectations are an interesting thing. In a recent survey of investors around the world, U.S. investors polled said they expect a 17.5% real return over the long term. Given that the S&P 500 has only returned 10.4% over the past 20+ years, one can see that those expectations are, well, not terribly realistic. What is realistic? Volatility is, and always will be, the constant we can hang our hats on – that is the nature of investing. There is no way to predict what the future holds. Certainly no one foresaw a 34% drop in the financial markets due to COVID; followed by a robust 68% rise in asset values to today’s all-time, record highs. When we looked back to updates from this time last year, the “expectations” were muted for recovery. It is amazing how time (and vaccines) cure what ails the markets and others.

We talked last month about the Fed and inflation expectations. Where do we stand? There are reputable economists on both sides of the inflation debate. No one wants to see a return to the double-digit inflation problems of the 1970s, and the Fed is more likely to react than was the case a generation ago. But we don’t expect the Fed to lift interest rates anytime soon, as central bankers continue to insist their focus is on full employment, and any rise in pricing pressures is temporary. Nonetheless, the best news on inflation is that the concern is probably behind us – for now. Bottomline: let the markets do what they will. You have better things to do with your summer months than worrying about Mr. Market and his maniacal minions. Conclusion Hopefully you have found this missive informative. Whatever your plans for the coming months may entail, please enjoy your summer and newfound independence. If you would like to squeeze in a little chat time, let us know – we would love to see you again. As always, thank you for the trust and confidence you place in us. It is something we never take for granted and sincerely appreciate. Please do not hesitate to reach out whenever you have questions, concerns or whenever we may be of service to you. Sincerely, Joe Downs, CFP® & John Cunningham, CFP Comments are closed.

|

Company |

Copyright © 2021, Reality Financial Planning Services, LLC. All rights reserved.

All rights herein are copyright protected and may not be reproduced without the express written permission of the copyright owner.

All rights herein are copyright protected and may not be reproduced without the express written permission of the copyright owner.