|

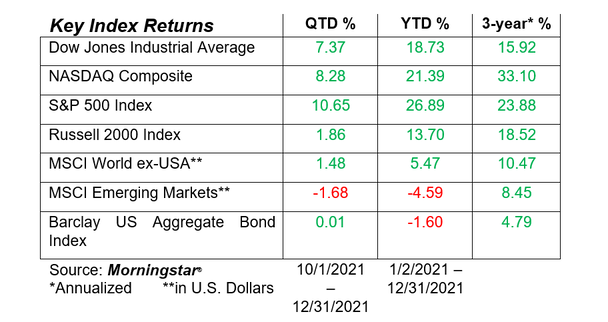

Dear Friends, In the inimitable words of my favorite comic strip character, Calvin (of Bill Waterson’s Calvin & Hobbes fame), “A new year…a fresh clean start”. However, another quote a few years later when talking about the new year, Hobbes said, “The problem with the future is that it keeps turning into the present.” Happy New Year to you. My hope for all of us is that this is a year of good health, much happiness and prosperity as we move forward with a life of fulfillment. Let’s hope that the acrimony surrounding vaccines, masks, politics, and general impatience with others can be replaced with open-minded compromise and more tolerance than we have seen over the past several years. ZOOM Webinars for Clients We will resume our Zoom webinars in February; stay tuned for updates of topics and dates. If there are any subjects for which a Zoom presentation would be relevant to you, please let us know. If you are so inclined, all our past presentations can be found in the Media & Posts tab on our website www.realityfinancialplanning.com. Schwab/TD Ameritrade Update The long-awaited merger between these broker/dealer behemoths is still proceeding at a snail’s pace. In a recent webcast to advisors, Bernie Clark, head of Advisor Services at Schwab, reiterated that the merger is still on pace to be completed “some time” in 2023. In the meantime, due to the overwhelming service demands of combining entities of this size, he also announced that additional staffing would be added to handle the surge in calls, paperwork and inquiries that have been causing annoying service disturbances and delays. (Sidenote: this has been a “challenge” wading through the quagmire). Cybersecurity Update The bad guys never rest. A critical flaw was discovered in software used widely across the Internet. Log4j is a software developed by Apache Software Foundation that allows networks, websites, and applications to collect information. It is said to be one of the web’s most widely used tools. The recently exposed flaw allows hackers to steal data, install malware, and take control of devices and networks by remotely executing code on a target’s computer. Some experts worry that the security vulnerability could lead to widespread ransomware attacks. And the beginning signs of these attacks have been spotted by some. Security experts are calling the Log4j vulnerability one of the most serious flaws they have seen in their careers. The cybersecurity firm Check Point reported that over 100 Log4j hacking attempts are occurring every minute. Microsoft says that nation-state hackers from China, Iran, and other countries are exploiting the flaw. Companies such as Apple, Amazon, Microsoft, Twitter, and Minecraft are affected by Log4j—among many others. Experts estimate that millions of servers are at risk. Apache Software has released a patch for the flaw—and many technology companies have already released their own updates. What does this mean for you? While companies and organizations - rather than individuals - are the real targets of this hack, there are actions you can take to protect yourself. First, update all your devices when you are notified. These updates may contain fixes for the Log4j vulnerability. Power down your devices periodically – that encourages update notifications.You should also be on the lookout for ransomware attacks. Whether reading texts or emails, exercise caution. Remember the acronym EMAIL: Examine Messages And Inspect Links! When in doubt, don’t click and delete the message. Market Perspectives Omicron is the sequel nobody wanted. Stocks have been whipsawed because case counts exploded over the past month. Last year at this time, I wrote the following: “While most of the country was quarantining or being locked down in 2020, Wall Street kept on chugging – moved by world events and then completely shrugging them off to move on quickly. The market had a year’s worth of losses in just over a month this spring, only to turn around and pack an entire bull market’s worth of gains into less than nine months. Even within the span of a few hours, the market in 2020 would sometimes careen to a loss that would have been remarkable for a full year.… The markets regained all its losses in less than five months and surged 64% from April through December.… The good news is that the crazy action for markets last year was likely a singular response to COVID-19, not a preview of a “new normal”. Most pundits say investors can expect movements in 2021 closer to what they were used to, as the economy is nursed back to health following the rollout of several Coronavirus vaccines. If anything, analysts say the whiplash provided another lesson that holding steady is often the best response for investors to crashing prices rather than trying to time the market. Panic selling was (and is) not a profitable strategy.” So, what comes around goes around. That recap was prescient (if I do say so myself). However, the shutdowns, cancelations, case counts, etc. may be challenging this coming January depending on how holiday gatherings are managed. But, at a certain point, stocks will react less to each piece of news. And eventually, it’ll be “let me guess, more/less cases. Great.” and stocks will rise or fall. You will not see this turn in sentiment coming, but it always comes. Omicron’s immediate impact on the economy is only now beginning to wash over us all, and the market’s ensuing reaction is anyone’s guess. The stock market can always be surprising (i.e., volatile) on the upside and downside. Stay tuned. Even the market bloviators have no idea what to expect (no surprise). What a year it was from a market performance standpoint! We ended the year near new highs in all the domestic equity indexes! You can raise a glass of your leftover champagne.

The prognosticators’ predictions are all over the place regarding 2022, but when has it been otherwise? If there is one lesson for us to take from this long, extended period of market prosperity, it is that the future is unknown, and the surprises more often favor the upside than the downside. We might be heading into a mild recession, or we might experience more booming economic growth. The markets will certainly pull back at some point, but that prediction has been made for each of the years that have contributed to the recent growth in stock values. A steady course has been surprisingly beneficial to investors in the face of many worries, but perhaps we shouldn’t be surprised, since that has always, long-term, been the winning investment strategy. Conclusion As always, thank you for the trust and confidence you place in us. It is something we never take for granted and sincerely appreciate. Please do not hesitate to reach out whenever you have questions, concerns or whenever we may be of service to you. Sincerely, Joe Downs, CFP® & John Cunningham, CFP® Comments are closed.

|

Company |

Copyright © 2021, Reality Financial Planning Services, LLC. All rights reserved.

All rights herein are copyright protected and may not be reproduced without the express written permission of the copyright owner.

All rights herein are copyright protected and may not be reproduced without the express written permission of the copyright owner.