|

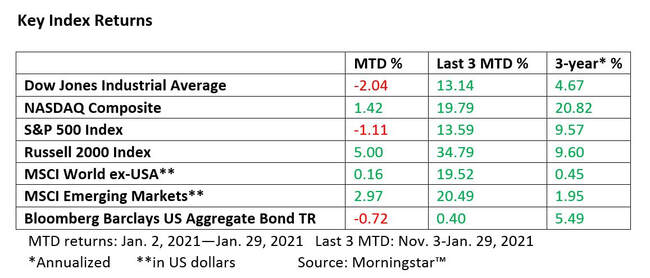

Dear Friends, The start of this year has been anything but boring. I hope you and your family are well and looking forward to an interesting year. A year ago, the first cases of COVID-19 showed up in Seattle. What many thought was just another flu virus (me included) proved to be something much worse and way more deadly. Everyone’s world changed and were impacted to varying degrees. Fortunately, there is hope on the horizon in the form of vaccines. Optimistically, a year from now this will be behind us and nothing more than a bad memory. And, hopefully, the political rancor will abate now that the elections and inauguration are behind us. “Unity” may be too much to ask for, but patience, tolerance and respect are not impossible. On the tax front Due to focusing their efforts on sending out the second round of relief checks, the IRS announced that they cannot accept 2020 tax returns e-filed until after Feb. 12. That gives you a little more time to gather your forms and documents. Also, due to the gathering of the data from multiple securities providers (especially those reporting for mutual funds, REITs and REIT ETF), most custodians for taxable, non-qualified accounts will be delayed in sending out 1099-Consolidated tax statements. The expectation is that those should be available around February 15, 2021. TD Ameritrade tax statements - 1099s - began posting online around January 21, 2022 (mailings to you may take a few days longer). The first wave sent were 1099R statements for distributions from retirement accounts (IRAs, etc.). Some simple 1099-Consolidate statements are also available. If you were eligible and did not receive your second stimulus payment of $600, you will need to file a tax return to claim it and receive it in the form of a refund. As happens every year, it will not be long before we hear of incidents of identity theft from bad guys filing bogus returns with unsuspecting taxpayer social security numbers. As I suggest every year, make every effort to file as soon as possible. However, be careful to not jump the gun in filing your taxes too soon without ensuring that you have received all necessary 1099, 1098, SSA-1099, or W-2s. Speaking of the "bad guys", and this is going to sound like "no brainer" advice, but, please, remind your friends, family, seniors, juniors and everyone in between that the offices of the IRS, Social Security Administration, and Medicare WILL NOT CALL YOU. It is amazing that phone scams are still occurring when people respond to these incendiary SPAM calls. Just hang up on them or don’t answer calls from unrecognized numbers. Cybersecurity ZOOM Webinar for Clients Speaking of protecting yourself against unscrupulous bad actors, John and I (the good guys) will be presenting our first client-only webinar focusing on cybersecurity and things you can do, and consider, to protect yourself from identity theft. We have done this workshop in various forms many times in the past and are delighted to have you join us virtually. We will have “room” space for 100 attendees. If you are interested in attending, the workshop will be Wednesday, February 24, at 5:00 and presented via ZOOM. To register, please email us at [email protected] and we will send you the log-in details. Market Update – “Stick it to The Man” or David vs. Goliath For most of early January, the markets were digesting the results of the election and hypothesizing about what additional stimulus measures would be forthcoming. The GDP numbers were good and unemployment rates in line with estimates. Corporate earnings were starting to roll out more positively than expected given the pandemic slow down. Last week, the financial media took a brief break from predicting everything that will happen in 2021 (do not laugh; it is their yearly habit) to bring us the engaging story of how masses of small amateur investors managed to bid the share prices of three largely-unprofitable companies—GameStop, AMC Entertainment Holdings and Blackberry—up nearly 1,000 percent, collectively. GameStop alone rose more than 14,300%—surely some kind of record for a firm whose market share is eroding and which most analysts think is clinging to an outmoded business model. (The company sells video games through bricks-and-mortar retail outlets in a world where everything can be downloaded.) In the interest of avoiding snarkiness (new word), the story was allegedly about David (the small investors) pitted against Goliath (several prominent multi-billion-dollar hedge funds), and the only reason you heard about it is because the small investors won and nearly put the hedge funds out of business. Market professionals recognize the story as a classic short squeeze: investors on one side (in this case the hedge funds) borrow the stock of companies they think are overpriced, expecting to buy them at a discount after the fall, allowing them to pocket a quick profit. These short sales have an expiration date, so if the stocks unexpectedly rise in price, the short sellers scramble to buy the stock at the inflated price to limit their losses. To raise the needed capital to cover their positions, shares in larger, well-established, and highly liquid stocks had to be sold (pushing down the price and, hence, a market decline). On the other side of the gaming table were a group of amateur investors engaged in online conversations on internet chat rooms (specifically subreddit r/wallstreetbets), who ganged up to raise each other’s bids. When the hedge funds were forced to buy the stocks to close out their positions, the share prices went through the roof. The hedge funds, meanwhile, lost an estimated $5 billion on their bets; roughly $1.6 billion on January 29, when GameStop’s stock jumped 51%. What the financial media neglected to mention is that this activity is not investing; it is, instead, a form of gambling, and the story tells us a great deal about the mindset of many retail investors these days. When their goal is to make bets, and destroy other gamblers at the table, the game for everybody else becomes increasingly dangerous. In no conceivable, rational way should a stock with a horrible business plan go from $17 per share 6 months ago to over $400 as GameStop’s stock price did. These roulette wheel spinning share owners are obviously not long-term investors. It is pure speculation when prices are bid up not based on the underlying value of the companies, but on the expectation that whatever you buy, at whatever price, someone else will come along and pay a higher price. Eventually, the share prices of GameStop, AMC Entertainment Holdings and Blackberry—and perhaps many other stocks that are being gambled with presently—will return to something that more closely resembles the real value of the real company. Long-term investors have tended to win the kitty over every past historical period, while gamblers have seen their short-term winnings evaporate in the ensuing bear market. The jubilant traders on subreddit r/wallstreetbets (does that name not suggest gambling?) can enjoy their winnings today, but it may not be long before they are counting their losses and wishing they had not gambled away the money that could be used to buy shares when they finally go on sale (or pay their rent). So, What Now?

With vaccines comes hope of getting back to normalcy. When the pandemic abates, the markets should find stable footing again. The Federal Reserve and President Biden’s economic staff are not likely to do anything nefarious to impact the recovery (keeping interest rates and income taxes low for the foreseeable future). What did get lost last year in the pandemic was the full, potential impact of the SECURE Act and how estate and long-term tax planning will be even MORE important to you than portfolio returns and asset allocation. This is a really big deal for people that own IRAs and qualified accounts. We will take a deeper dive on the topic in the coming weeks and as we do our periodic reviews. Bottom Line Hang in there! If you have not received your vaccine yet, hopefully it will be soon. In the meantime, take care of yourself, stay safe, enjoy your life. As always, if you have questions, concerns or would like to chat about anything, please let me know. Thank you for the opportunity to be of service. Sincerely, Joe Downs, CFP® and John Cunningham, CFP® Comments are closed.

|

Company |

Copyright © 2021, Reality Financial Planning Services, LLC. All rights reserved.

All rights herein are copyright protected and may not be reproduced without the express written permission of the copyright owner.

All rights herein are copyright protected and may not be reproduced without the express written permission of the copyright owner.