|

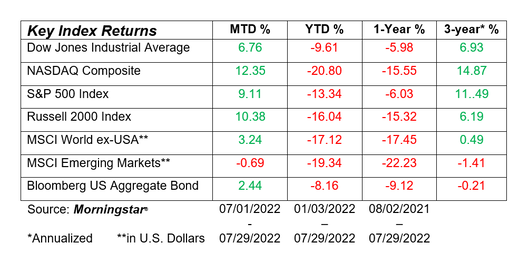

Greetings Friends, Hopefully you are enjoying your summer and staying cool. For my education professional friends and clients preparing to go back to school soon, thank you in advance for what you do and all the best for a great new school year. While the TV news can be depressing if you let it, there is salvation and good news on the horizon: Hallelujah the long wait is almost over – football season starts soon! For those of us keeping score (waiting anxiously), the first NFL preseason game (I know how pathetic that sounds) is Thursday, August 4; the first regular college games start Saturday, Aug. 27. Gear up! Personal Note of Thanks and Welcome As most of you know, this firm is fortunate to count education professionals as our core niche. Our growth and success would likely not have been as profound but not for one person who believed in what we stood for and allowed us the opportunity to be of service to her members: Pat Gardner, the past president of the Sarasota Classified/Teachers Association (SCTA). I first met Pat 20 years. A few years later when I decided to start my own firm, she asked me to provide educational workshops on financial planning matters for the members of the SCTA. Her trust and confidence were pivotal in helping us build a prosperous practice. The relationships we developed have been priceless, and we cannot express our gratitude to Pat enough. We wish her a gratifying and fulfilling retirement and hope she does all the wonderful things she has always wanted to do. Thanks again, Pat, and best wishes on your next journey. The SCTA membership made an outstanding choice to fill Pat’s shoes. We whole-heartily welcome Rex Ingerick to his new role and wish him much success and prosperity as he takes the leadership reins of the SCTA. We look forward to working with Rex to continue the long history of service to education professionals throughout Sarasota County. All the best, Rex! Social Security Benefits Going Up? We never know for sure until the announcement by the Social Security Administration each October, but it sure looks like people receiving benefits will get a big raise in 2023. Experts are predicting a 10.5% cost of living (COLA) adjustment, based on recent changes in the Consumer Price Index. The last time Social Security benefits rose by double digits was 1981, when recipients received an 11.2% raise. Back then, the standard Medicare premium was $89 a month. Taxwise, the increase could be a mixed blessing. More benefits will expose more Social Security income to federal income taxes; any joint return whose combined income (including Social Security income) exceeds $32,000 will trigger taxation of benefits, and higher income could also result in higher income-adjusted Medicare premiums. Those premiums are already becoming costlier; this year, Medicare Part B premiums rose 15.5%—higher than the Social Security cost of living adjustment. That means that Social Security recipients who had Medicare premiums automatically deducted saw their monthly checks go down, despite the reported upward adjustment in benefits. However, one of the reasons Medicare premiums increased so dramatically this year was anticipation of coverage for a controversial Alzheimer drug called Aduhelm. But most of those anticipated costs never materialized, as the drug was only provided limited approval and Medicare acknowledges that the large premium increase may have been unjustified (AARP). For now, it may be unlikely that another big premium increase next year will be necessary. Medicare officials are expected to announce the 2023 Part B premium in the fall. Sources: https://www.barrons.com/articles/social-security-cpi-inflation-2023-cola-estimate-51657726256?siteid=yhoof2 https://www.ssa.gov/policy/docs/statcomps/supplement/2011/2b-2c.html Market Update Even with all the “gloom and doom” narrative so pervasive on the business talking head channels, we finally saw positive monthly returns in July for the equity markets - the largest monthly gains for the indexes since 2020. Also, as was widely expected, the Federal Reserve increased interest rates another .75% in an effort to stave off the effects of inflation. Recall that the Consumer Price Index (CPI) – the Feds favorite measure for inflation, increased 9.1% in June – the highest monthly rate since November 1981. However, all indications are that that number was maybe an anomaly. With a few more (likely lower) rate hikes on the horizon, the Fed is hoping to achieve a “soft landing” – slowing down the economy without sending it into a tailspin. We feel that the Fed is doing what they need to do to ameliorate the inflation situation – so far. The naysayers were able to thump their “recession-lauding” chests with the release of the quarterly GDP numbers, showing that economic activity dropped by .09% from April to June following a 1.6% drop in the first quarter. Consecutive quarters of lower GDP reports are the traditional indicator that a recession may be imminent. However, much more goes into that declaration, and one could argue that maybe we may be heading OUT of the recession (if indeed there was one).

In a report published by Vanguard, their thesis is that economic activity will pick up and show economic growth by year end to be around 1.5% - not great, but no negative. They point to lower oil prices, a return to the workforce of many of the unemployed, lower consumer inflation expectations (eventually) and bigger retail inventories (consumers focusing on services rather than accumulating “stuff”). To recap the economic scorecard: interest rates are up; however, inflation may start to come down. Consumers are still spending (albeit more slowly and carefully), and thankfully gas prices are WAY lower than earlier this year. Unemployment rates are still relatively low historically. And most importantly, more than half of the companies in the S&P 500 have reported earnings for the past quarter and 72% of them have beaten profit expectations (FactSet). It is too early to sound the all-clear (my crystal ball won’t allow that). But there is much to which we can look forward to and remain positive. Final thoughts As always, thank you for the trust and confidence you place in us. It is something we never take for granted and sincerely appreciate. Please do not hesitate to reach out whenever you have questions, concerns or whenever we may be of service to you. Sincerely, Joe Downs, CFP® & John Cunningham, CFP® Comments are closed.

|

Company |

Copyright © 2021, Reality Financial Planning Services, LLC. All rights reserved.

All rights herein are copyright protected and may not be reproduced without the express written permission of the copyright owner.

All rights herein are copyright protected and may not be reproduced without the express written permission of the copyright owner.