|

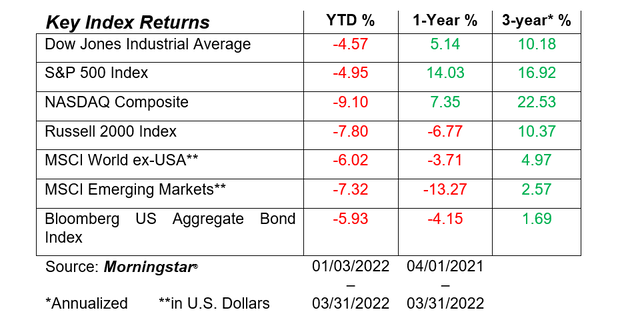

Dear Friends, Spring has sprung! As March Madness concludes, the beautiful Florida weather has returned just as the Snowbirds are leaving, restaurant lines will get shorter and golf courses' greens fees become affordable. (Yes, that is a retread line from year’s past, but less snarky than referencing April Fool’s Day). Hopefully this note finds you well. Very soon, school will be out for the summer. When that happens, many children that rely on free or reduced meals at school will go hungry as their families struggle to feed them at home. As supporters of the All-Faiths Food Bank, we encourage you to consider reaching out to them with any financial help you may be able to provide. As their tagline reiterates: Child hunger is a problem we can solve together. ZOOM Webinars for Clients Exogenous, “Black Swan”, unexpected events happen. In our lifetimes, we can recount numerous things that occurred that may have seemed unprecedented at the time. Inflation happens. The actions of a maniacal despot in the invasion of Ukraine can certainly be unsettling. However, how the markets react to them can be fairly predictable. On April 27, from 5:00 – 6:00, John and Joe will share our perspectives of how investors and the markets deal with issues like we have seen in this month’s Zoom Webinar for Clients. If you are interested in attending, please email us at [email protected] and John will send you the ZOOM meeting details. As an FYI, all our past presentations can be found in the Media & Posts tab on our website www.realityfinancialplanning.com. If there are any other topics for which a Zoom presentation would be relevant to you, please let us know. Why Open a my Social Security Account? We have all heard warnings not to give out our Social Security numbers anywhere—not on the phone, not online. So, it might seem counterintuitive to set up an online account for managing your Social Security benefits. However, this is the exception, and let us explain why. We encourage everyone to go to ssa.gov/myaccount and open a my Social Security account. This is not just for people who are close to retirement. Everyone should open their own account with SSA. Defense against fraudstersOne woman reported that when she tried to open her my Social Security account, she was told that an account had already been opened under that Social Security number. The security questions used to establish her identity were not questions she would have chosen. There are numerous other chilling stories about hackers applying for benefits using stolen Social Security numbers. The best defense against someone else opening an account or applying for benefits under your number is to open your own account and check it often. This is especially true for anyone over full retirement age who has not yet applied for benefits. The first reason to open a my Social Security account is to do it before someone else does. In “Social Security benefits hacked: A cautionary tale,” a financial advisor who had planned to file for benefits at age 70 received a letter one month after turning 67 congratulating him on initiating his Social Security benefits. It turns out a thief had applied for benefits using his Social Security number and made off with over $19,000 in benefits before it was discovered. The thief had applied for benefits online using his Social Security number but a different email address, phone number, and bank. Because the online application would not allow the mailing address to be changed, the letter went out to the owner of the Social Security number and that’s how the author discovered the fraud. The second reason is to make sure someone else isn’t receiving benefits under your number. By opening an account and checking back regularly, you can monitor activity. If you are over full retirement age but haven’t applied for benefits, be especially watchful. It seems the fraudsters are waiting until people turn 66½ and applying at that time so they can get six months of retroactive benefits in a lump sum. Safe and easyIf you are worried about online security, the my Social Security account website seems to be very secure. It requires a username and strong password that must be changed every six months. Each login requires a unique code sent by text or email. For an extra layer of protection people can set it up to require answers to financial or identity verification questions. Not setting up a my Social Security account is the riskier option. After the 2017 Equifax hack, you may have been advised to freeze your credit files (something we strongly encourage). If you have done this, you will need to lift the freeze long enough to open the my Social Security account, since SSA accesses users’ credit files to verify their identity. This is easy enough to do (providing you saved your PIN). The credit inquiry by SSA comes up as a “soft” inquiry which does not affect one’s credit score. What you can do with your accountOnce the account is set up, you can access your latest Social Security statement on demand. This is important for anyone under age 60 who will not receive a statement in the mail, or for anyone over 60 who may have misplaced their paper statement. The primary insurance amount (PIA) on your statement is critical for analysis and planning. If you are still working, check your earnings record each year—employers usually report by March or so. Those currently receiving benefits can see the record of payments and the breakdown of each payment: gross amount and deductions for Medicare premiums and taxes. You can also download a benefit verification letter, which serves as proof to lenders or anyone else requiring evidence of income that you receive Social Security benefits in the amount shown on the letter. Given that we are in tax time, you can also access a copy of your 1099-SSA for reporting your taxable social security benefits if you did not receive or misplaced the mailed copy. As you may know, new Medicare cards have a unique Medicare number to replace the Social Security number that appeared on the old cards. You can also find this on your my Social Security account. If you have any questions or need help setting up your account, we’re happy to help. Market Review The first part of this year saw more market moves than NFL quarterbacks in the offseason. Take the Fed finally addressing the removal of quantitative easing and increasing interest rates, to the Ukraine invasion, and higher inflation rates, it is no wonder that the Doomsayers’ prediction of a market correction finally occurred. But like Tom Brady changing his mind about retiring, the market made a comeback. For all the handwringing, angst and stomach churning from the markets drop, we saw a little recovery off the lows in March. Where Is the Inflation Coming From?

Let’s do full disclosure here: we are NOT economists and never pretend to be. But we are very aware of what seems to be top-of-mind on the cable business channels and some mainstream media (as much as we would like to avoid it). By now you know that the U.S. is experiencing an elevated rate of inflation. The Consumer Price Index rose 7.9% last year, and prices this year are surging as well. The question that is not being asked, however, is how much of these rising prices are a result of supply chain issues and higher worker wage demands, and how much are reflecting higher profits? If worker pay has gone up at roughly the inflation rate, then we can pinpoint the higher costs that companies are having to pass on at the register. By this measure, however, worker costs are running substantially behind price increases; the average hourly wages across the U.S. economy rose 4.7% last year, while inflation grew by 7.9%. A more credible place to look for the drivers of inflation is the snafus in the supply chains running here, there and everywhere, only to be held up idling outside of ports or ceasing altogether whenever another bout of COVID strikes. Ocean shippers made nearly $80 billion in the first three quarters of 2021, which is twice as much as in the entire ten-year period from 2010 to 2020. Freight rates have increased tenfold, and companies are effectively paying for ships that stand waiting their turn for weeks outside of major ports. Shipping and associated delays are clearly driving up manufacturing costs. Even so, the fact that we are seeing high inflation at the same time as corporate profit margins are at their highest level in 70 years cannot be totally coincidental. When Fortune magazine looked at the profit margins on 28 food and consumer goods from manufacturers listed on the Fortune 500, it found that the net profit margins were higher than pre-pandemic levels on 14 of them, and roughly the same on the others. Datasembly™, which tracks food and consumer goods manufacturers, found that 11 of a sampling of 18 key consumer products had experienced inflation-beating price increases. JBS, Kellogg, Kimberly Clark and Tyson all raised their prices higher than the current inflation rate, with the JBS steaks and Tyson Buffalo-style chicken bites rising a whopping 34% and 26.7%, respectively. Molson Coors and Procter & Gamble more than doubled their profit margins last year, compared to pre-pandemic levels. (Source: Fortune.com) When the COVID-19 pandemic shut us all down, no one was driving anywhere (and no one complained about $2.00/gallon gas). Now that we are “open” again, oil producers that cut way back on production due to the reduced demand are playing catch-up to build reserves to meet the new supply needs and gas prices went up accordingly (as has oil companies’ profits). Supply and demand – basic economics. It is helpful to remember, when members of Congress throw around terms like ‘price gouging,’ that any company is legally entitled to set prices at whatever the market will bear – that is called Capitalism. Some of those price increases are set at the store level, so if there is exploitation, it may not all be at the manufacturing or producing level. The bottom line is that if customers are willing to pay 25% more for something this year than they did last year, then that’s simply evidence of capitalism at work. Granted, no one asked us if we WANT to pay more for food, gas, greens fees, etc. At some point, consumers might stop simply accepting the conventional wisdom from news sources that our current inflation can be directly traced to higher production prices. We can choose to not pay the prices. If that realization ever happens, you can expect people to halt buying. Prices will drop, and corporate profits will fall back to more normal levels—or below. But like stock market fluctuations, what is painful at a given moment is likely to ameliorate over time – if we can be patient. Final thoughts Hopefully you have or will be making plans for safe travel this summer. Take care, be well, enjoy yourself, and don’t forget the sunscreen. As always, thank you for the trust and confidence you place in us; it is something we never take for granted and sincerely appreciate. Please do not hesitate to reach out whenever you have questions, concerns or whenever we may be of service to you. Sincerely, Joe Downs, CFP® & John Cunningham, III, CFP® Comments are closed.

|

Company |

Copyright © 2021, Reality Financial Planning Services, LLC. All rights reserved.

All rights herein are copyright protected and may not be reproduced without the express written permission of the copyright owner.

All rights herein are copyright protected and may not be reproduced without the express written permission of the copyright owner.