|

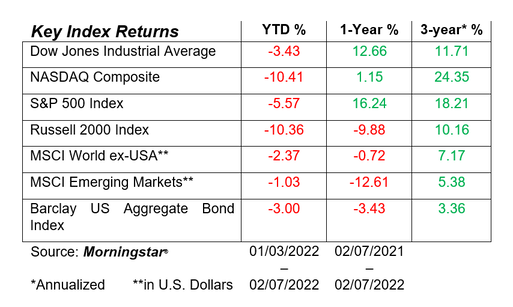

Dear Friends, Because it is another unseasonably dreary day, I thought I would reach out and share some pearls of wisdom (?), insights, and general stuff. ZOOM Webinars for Clients We are excited (and you can be too) that our next Zoom webinar will be Wednesday, February 23, at 5:00. Have you ever wondered how and why we construct portfolios (and invest our own money) the way we do? There are as many investment approaches out there as there are financial advisors. Some work, some don’t. But through years of research and due diligence we have found that there is no doubt that passive index investing has outperformed active investing over the long-term. So, we have decided to share our philosophies and methods for using indexes and why we think that approach is superior to many others. Please join John (and I) as he presents the nuts and bolts of the RFPS Investment Planning Strategies. If you are interested in attending, please email us at Inquire@RealityFinancialPlanning.com and John will send you the ZOOM meeting details. As an FYI, all our past presentations can be found in the Media & Posts tab on our website www.realityfinancialplanning.com. If there are any other topics for which a Zoom presentation would be relevant to you, please let us know. Bad Guys Never Go Away It wasn’t that long ago when our money and assets were safe, or at least there was a high degree of perceived safety. Investment accounts were secured by SIPC insurance. The same could be said about FDIC-insured bank accounts. And, if you spotted a fraudulent charge on your credit card, all that was required was a quick phone call to the number on the back of your card, and it was removed. Sure, there were fraudsters and scammers, but potential access to your personal finances was much more limited. Those same SIPC, FDIC, and credit card protections remain in place today. Unfortunately, the advent of the Internet, social media, and a global reach have led to a proliferation of scams that can quickly deliver a knockout blow to your savings. While you need not be in a perpetual state of readiness, a healthy level of vigilance and skepticism can go a long way. It will protect your savings and prevent you from becoming a victim of fraud. How can you avoid becoming a victim? The Federal Trade Commission (FTC) highlights four elements that can help you spot a scam. 1. Scammers PRETEND to be from an organization you know. They may claim to be from the Social Security Administration, the IRS, a bank, a well-known company such as PayPal, Netflix, or Amazon, or your local utility. Never give someone your password, bank information, PIN number, social security number, or personal identifying information. Never settle a debt or problem over the phone from an unexpected call that came your way. Many solicitors are scammers looking for money. If you pay these criminals, they will come back in a short period of time, claiming another discrepancy was found and another payment is needed. 2. Scammers say there’s a PROBLEM or a PRIZE. You’ve won a big prize, just make a good faith down payment to receive your winnings. If you do, you’ll never see that money again. 3. Scammers PRESSURE you to act immediately. Whether a scammer or salesperson, pressure to act immediately is a red flag. Hang up the phone. You are in control. Don’t cede that control to someone else. 4. Scammers tell you to PAY in a specific way. They may insist you send money through a money transfer company or put money on a gift card. Then, they will ask you to give them the number on the back of the gift card. Alternately, someone will send you a check, request you to deposit it, and ask you to send them some of the money. That check will bounce after you’ve delivered the cash to the scammer. Major scams targeting older Americans Older adults lost $600 million to fraud in 2020, when the pandemic fueled spikes in almost all top categories of fraud, federal officials say. Whether it is Zoom phishing emails, Covid-19 vax card scams, phony online websites, or romance scams, please be leery when you venture online or on social media sites. Recently, the AARP highlighted some the avenues fraudsters use to take your money. For example, “You receive an email, text or social media message with the Zoom logo, telling you to click on a link because your account is suspended or you missed a meeting,” says Katherine Hutt, national spokesperson for the Better Business Bureau. “Clicking can allow criminals to download malicious software onto your computer.” Others will exploit what might be called the flavor of the month or topic of the day. Recently, the government said it will offer free Covid test kits. You can obtain yours at covidtests.gov/. The site takes you directly to special.usps.com/testkits to order. But criminals attempt to impersonate these sites by adding a few letters or a word like “free” within the link. The link appears legit, but it’s not. The fraudulent site will encourage you to divulge personal information. Avoid being defrauded by following several commonsense tips offered by the FTC. 1. Block unwanted calls and text messages. 2. Don’t give your personal or financial information in response to a request that you didn’t expect. Legitimate organizations won’t call, email, or text to ask for your personal information. 3. If you get an email or text message from a company you do business with and you think it’s real, it’s still best not to click on any links. Instead, contact them using a website you know is trustworthy. Don’t call a number they provided or the number from your caller ID. 4. Resist the pressure to act immediately. Legitimate businesses will give you time to make a decision. 5. Know how scammers tell you to pay. Never pay someone who insists you pay with a gift card, by using a money transfer service, or by setting up a PayPal account. Additionally, never deposit a check and send money back to someone. 6. Stop and talk to someone you trust. Finally, avoid the temptation of telling a scammer what you think of him or her. In researching this article, I came across those who regretted such action. Yes, they may have been an ocean away from the scammer, but that didn’t prevent a vindictive fraudster from placing the victim’s phone number on numerous fake ads or overwhelming them with robocalls. Remember, they are sophisticated criminals that have access to the latest technology. If, unfortunately, you find you have become a victim, you can report the incident to the FTC at https://reportfraud.ftc.gov/#/ Just remember: Delete suspicious emails, ignore suspicious texts, hang up, and don’t argue with scammers. Market Review – Just a little shaky There are plenty of reasons why inflation is at a 40-year high: easy money and low interest rates, rising wages, supply chain disruptions, and fiscal stimulus that has fueled demand for consumer goods. And all of this is happening at a time when food and energy costs are rising. I could argue that these are signs that the economy is recovering and not necessarily a “bad thing”, but then market pundits don’t check with me. Last year, the Fed insisted the jump in inflation would be temporary--“transitory” was its word of choice. But inflation proved to be more troublesome than they expected, transitory was retired, and the Fed quickly pivoted. Gone are pledges to keep the fed funds rate at near zero through at least 2023. Instead, Fed Chief Powell seems determined to bring inflation back under control, and that means the Fed is contemplating a series of rate hikes in 2022. His more aggressive approach created volatility for the first few weeks of the year, as investors attempted to price in several rate hikes this year. Powell warned that inflation could remain stubbornly high this year. Or, it’s possible supply chains will settle down and lessen the need for a strong central bank response. (Federal Reserve, St. Louis Federal Reserve)

The Fed’s challenge: engineer a soft economic landing, which brings down inflation without throwing the economy into a recession. Barring a significant health crisis or a major geopolitical event, the Fed’s new posture will probably be the focus this year. That will likely keep bring more volatility – nothing new from our perspective and no reason to deviate from your plans. Final thoughts As we mentioned a few weeks ago: Though the market pundits finally got the 10% decline that they have been espousing for two years, remember that a broken clock is right twice a day. Risks never completely abate. Certainly, inflation may be a concern and the Fed COULD move too quickly. Another variant could be discovered next month. And Tom Brady could retire (and did). Are we overly concerned about markets now? Not really. Always remember our focus is the long-term. If there is a major reason to do something, we certainly will respond accordingly. As always, thank you for the trust and confidence you place in us. It is something we never take for granted and sincerely appreciate. Please do not hesitate to reach out whenever you have questions, concerns or whenever we may be of service to you. Sincerely, Joe Downs, CFP® & John Cunningham, CFP® Comments are closed.

|

Company |

3947 Clark Road, Sarasota, Florida 34233 Office: (941) 366-5700 inquire@realityfinancialplanning.com |

Copyright © 2021, Reality Financial Planning Services, LLC. All rights reserved.

All rights herein are copyright protected and may not be reproduced without the express written permission of the copyright owner.

All rights herein are copyright protected and may not be reproduced without the express written permission of the copyright owner.